PH SSS Member Loan Application 2006 free printable template

Show details

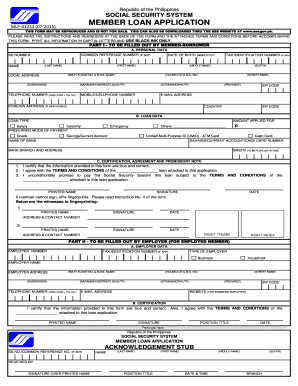

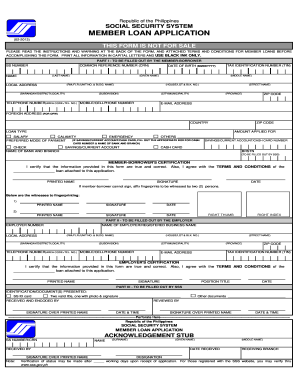

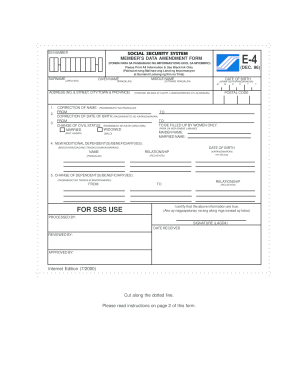

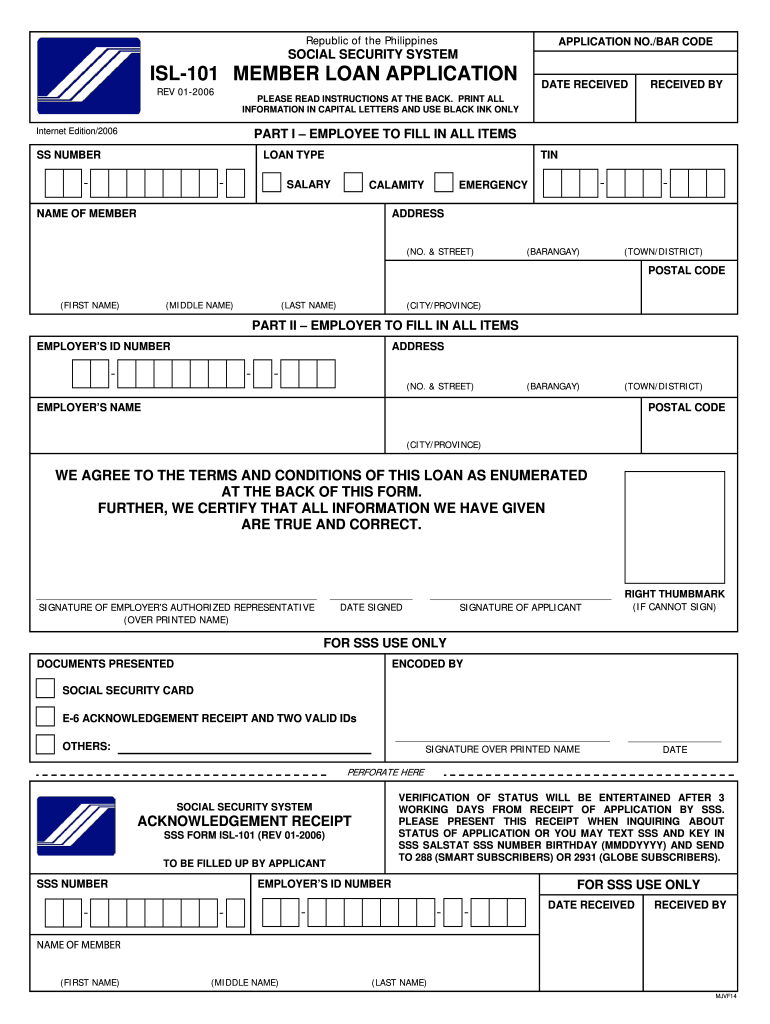

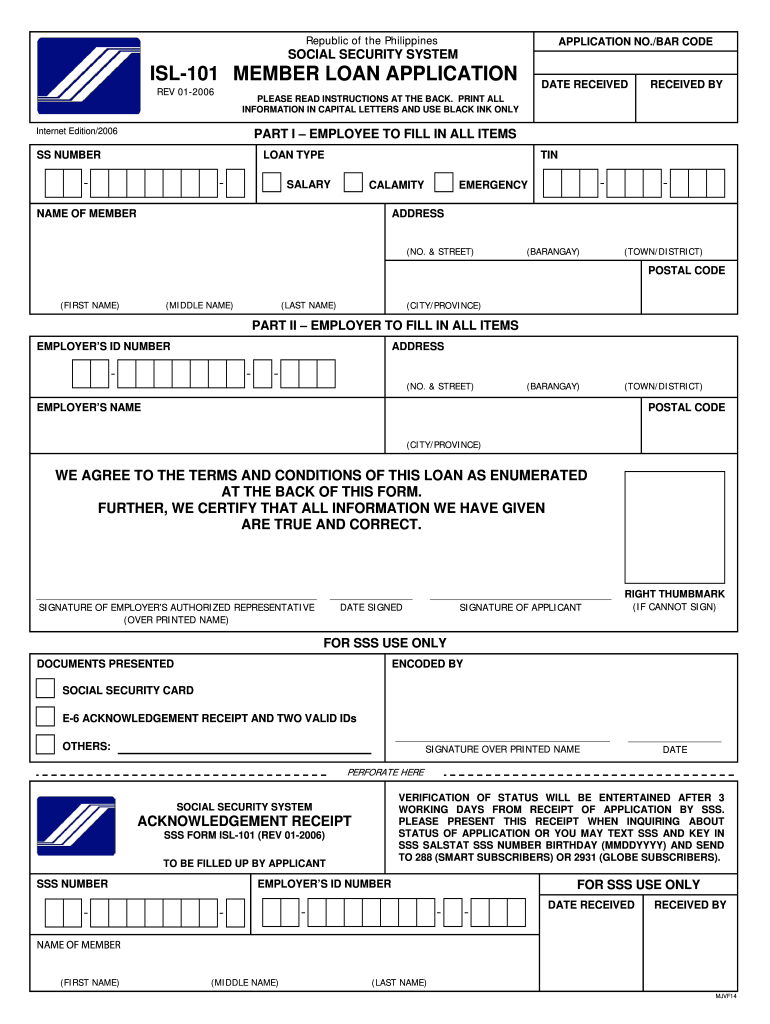

ACKNOWLEDGEMENT RECEIPT SSS FORM ISL-101 REV 01-2006 TO BE FILLED UP BY APPLICANT MJVF14 TERMS AND CONDITIONS APPROVED UNDER SOCIAL SECURITY COMMISSION RESOLUTION NO. 669 DATED 10 DECEMBER 2003 A. SALARY LOANS ELIGIBILITY REQUIREMENTS 1. AN EMPLOYED CURRENTLY PAYING SELF-EMPLOYED OR VOLUNTARY MEMBER SE/VM WHO HAS 6 POSTED MONTHLY CONTRIBUTIONS FOR THE LAST 12 MONTHS PRIOR TO THE MONTH OF FILING OF APPLICATION. 2. Republic of the Philippines APPLICATION NO. /BAR CODE SOCIAL SECURITY SYSTEM...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign PH SSS Member Loan Application

Edit your PH SSS Member Loan Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH SSS Member Loan Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PH SSS Member Loan Application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PH SSS Member Loan Application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH SSS Member Loan Application Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH SSS Member Loan Application

How to fill out PH SSS Member Loan Application

01

Obtain the PH SSS Member Loan Application form from the nearest SSS branch or download it from the official SSS website.

02

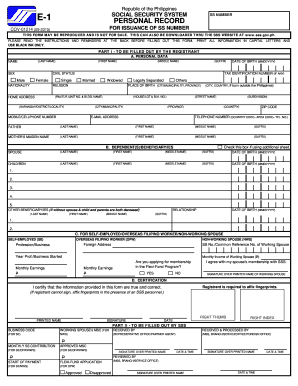

Fill out the application form with accurate personal information, including your name, address, and SSS number.

03

Indicate the type of loan you are applying for (e.g., salary loan, housing loan).

04

Provide the required details about your employment and income.

05

Attach the necessary supporting documents, such as a valid ID and proof of income.

06

Review the application form to ensure all information is complete and correct.

07

Submit the application at the nearest SSS branch or designated SSS service center.

Who needs PH SSS Member Loan Application?

01

Any active member of the Philippine Social Security System (SSS) who requires financial assistance for personal needs.

02

Members who have contributed to the SSS for the required number of months and are in good standing.

03

Employees, self-employed individuals, and voluntary members seeking loan options for various purposes.

Fill

form

: Try Risk Free

People Also Ask about

Can I apply SSS loan online application form?

SSS can submit the salary loan application online. The salary loan submitted online by an employed member will be directed to the employer's My. SSS account for certification, hence, the employer should also have an SSS Web account.

How much can I apply for salary loan SSS?

Anyway, since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month salary loan, and Php 50,000 for a two-month salary loan.

How can I calculate my SSS loanable amount?

LOAN AMOUNT A two-month salary loan is equivalent to twice the average of the member-borrower's latest posted 12 MSCs, rounded to the next higher monthly salary credit, or amount applied for, whichever is lower.

How to apply for SSS loan step by step?

SSS Salary loan online process Step 1: Got to My. SSS Portal via browser. Step 2: Select Member's Log in. Select the 'Member' button to access the member's login page. Step 3: Select E-Services. Step 4: Provide Bank Details. Step 5: Wait for SSS approval. Step 6: Select Apply for Salary Loan. Step 7: Review your Application.

What is the maximum SSS salary loan?

Anyway, since the maximum Monthly Salary Credit is currently 25,000, members who pay the maximum amount of monthly contribution can borrow the maximum loanable amount of Php 25,000 for a one-month salary loan, and Php 50,000 for a two-month salary loan.

How much is the 1st loan in SSS?

The salary loan amount is equivalent to one month's worth of salary. You can also apply for a two-month salary loan if you have at least 72 months of posted contributions, six months of which have been posted in the last 12 months before the month of application.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PH SSS Member Loan Application without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including PH SSS Member Loan Application, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send PH SSS Member Loan Application for eSignature?

Once your PH SSS Member Loan Application is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit PH SSS Member Loan Application on an iOS device?

Use the pdfFiller mobile app to create, edit, and share PH SSS Member Loan Application from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is PH SSS Member Loan Application?

The PH SSS Member Loan Application is a formal request initiated by members of the Social Security System (SSS) in the Philippines to borrow funds against their contributions to the SSS. It allows eligible members to access loans for various personal financial needs.

Who is required to file PH SSS Member Loan Application?

Members of the SSS who meet the eligibility criteria, such as having the required number of contributions and being in good standing, are required to file the PH SSS Member Loan Application in order to obtain a loan.

How to fill out PH SSS Member Loan Application?

To fill out the PH SSS Member Loan Application, members must obtain the appropriate form from the SSS website or branch, provide personal information, indicate the desired loan amount, and disclose any other required documentation or data as specified in the application form.

What is the purpose of PH SSS Member Loan Application?

The purpose of the PH SSS Member Loan Application is to provide members with a systematic process to apply for loans, enabling them to borrow funds for emergencies, education, home improvement, or other personal financial needs.

What information must be reported on PH SSS Member Loan Application?

The information that must be reported on the PH SSS Member Loan Application includes the member's personal details (name, date of birth, SSS number), loan amount requested, purpose of the loan, employment information, and any existing loans with SSS.

Fill out your PH SSS Member Loan Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH SSS Member Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.